E - Invoice

Businesses having a turnover of ₹500 crore or more would take up e-invoicing from 1stJanuary 2020 on voluntary and trial basis while the businesses with turnover of ₹100 crore or more would start e-invoicing on voluntary and trial basis from 1st February 2020.

However, from 1stApril 2020, the e-invoicing will be mandatory for both these categories

Why E – Invoice (IRN)?

Mandatory for availing the credit

Avoid false claims by fictitious Invoice

Avoid alternation of Invoice details

Simplification of Reports

Entune’s Value Proposition

SAP Authorized Partner in providing e-invoicing solution

End 2 end solution provider covering License, Implementation, User Training and Post Go-Live Support

Provide value add services to further strengthen compliance by

- Enabling digital signature for outbound invoices

- Validate IRN Number for incoming material

- Provide DCS implementation service covering GSTR return filing

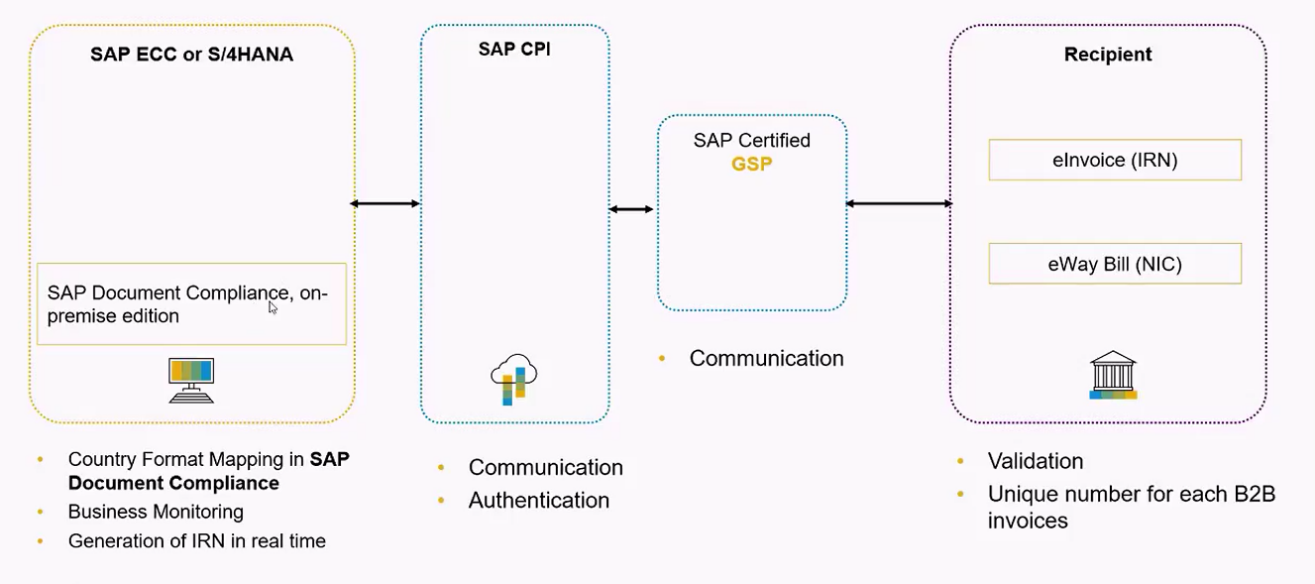

SAP Key Features

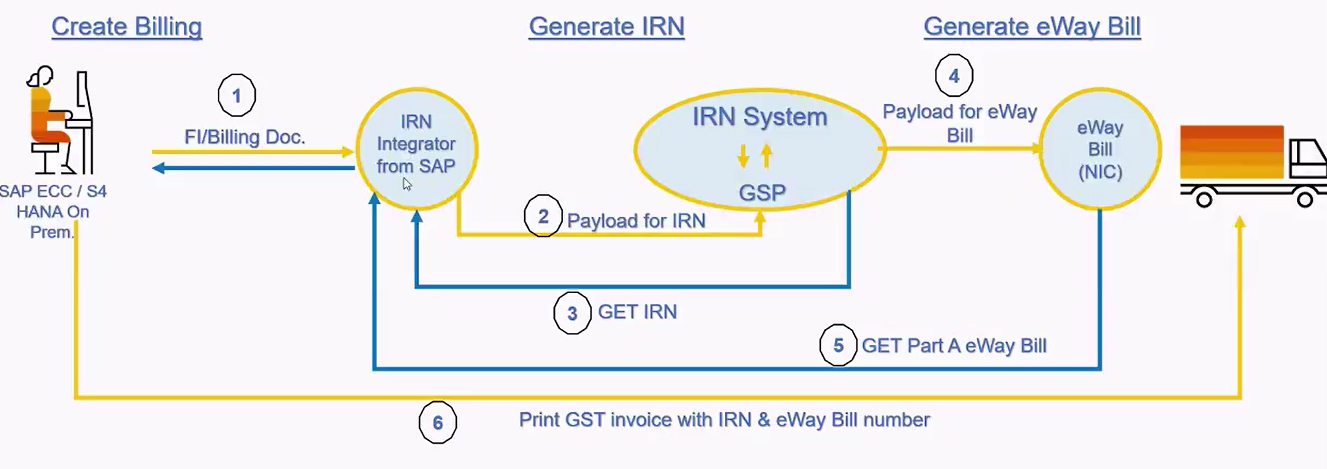

Generation of IRN in real time

IRN based reconciliation with Billing document in S/4HANA

Collection of QR code from portal and available for further print

Enable reconciliation between

- IRN and e-Way Bill

- IRN and e-Way Bill and Annexure 1

Cancellation of IRN

Auto-generation of Part A of e-Way bill.

SAP IT Flow

SAP Process Flow

+91 6364883355

+91 6364883355