SAP Digital Compliance Services

SAP as an Application Services Provider for Goods and Services Tax India

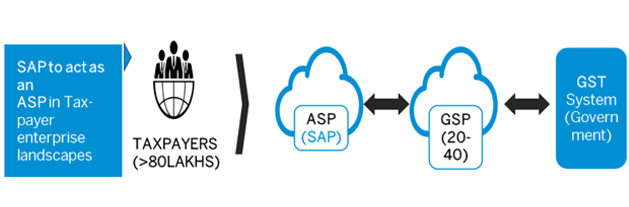

The introduction of Goods and Services Tax (GST) in India, brings in a new regime of tax compliance, moving from filing of tax reports to a model based on data communication between the you as the tax payer and the GST Network (GSTN) organization. GSTN has introduced two new entities, GST Suvidha Provider (GSP) and the Application Service Provider (ASP) , whose roles are to facilitate the data communication to the GST system at GSTN in the required format.

SAP shall offer ASP services in the Tax Payer enterprise landscape through the SLH, Digital Compliance Service solution for India offered on SAP Cloud Platform. This solution shall offer consolidation capabilities at a GST Registration level of your organization of data from disparate systems and is designed around a framework driven approach for reporting.

ENTUNE successfully supported the deployment of SAP Digital Compliance Services for India’s one of the largest FMCG industry

Scope of SAP Digital

Compliance Services

- Details of Outward Supplies

- Details of Inward Supplies

- Input Credit Reconciliation

- Monthly Return

- ISD Return

- TDS Return

- Annual Return

- Data Transfer Monitor at ECC Level

Key Benefits of the Solution

- Consolidation of data from disparate systems

- Embedded drill down capabilities

- Data Protection and Security as per GSTN guidelines and of global standard

- Easy to use Analytical tools with Dashboard that helps monitor your data communication to GSTN

- Provides Scalability, High Transaction Volume Management, Data Security and Supply Data Consolidation

+91 6364883355

+91 6364883355